Gunn used a form of technical analysis referred to as the Elliott Wave Principle to reach this conclusion. Business looked first to retained profits to fund investment on which future profits were based but did so in the clear knowledge that any shortfall could easily be addressed by approaching the market. That’s easy – because a stock market crash isn’t obvious and anybody claiming they know so with near certainty is being untruthful. These three stock market crash warnings show there might not just be a market crash, but a historic one. The Great Depression started with the Great Market Crash, causing serious economic problems in some other countries.

Basing your investing strategy around avoiding crashes will put you on the sidelines for most of the time because there is rarely a week that goes by when some financial pundit will try to convince you that the market is about to go off a cliff. These indicators cannot be expected to give meaningful readings when the market is being manipulated. This should be viewed as preliminary descriptive analysis that cannot estimate the magnitude of the effect of the stock market crash, for two reasons. Jones and Garzarelli received massive attention in the wake of the crash, with the media framing them as all-knowing market seers.

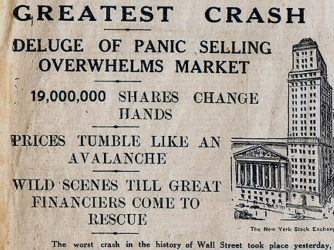

After this dismal week, prices continued to fall, wiping out an estimated $30 billion in stock values by mid-November 1929. The folks at Ned Davis Research, one of the most widely respected research houses around, just tweeted out some data that warrant consideration, suggesting that on a relative basis, stock market valuations look ok. This led to lower interest rates and the need for investors to pour more money into the stock market.

Investors were also given a breathing space, time to change their minds over stock purchase rather than having to regret an instant decision. According to Kezdi and Willis (2008) , it took a five hundred point gain in the Dow Jones to generate a one percentage point gain in expected yearly returns in 2002. From our spots on the wall, watchmen such as myself all over the nation are sounding the alarm about what we clearly see coming. The HRS released the names of all sample households to its national field staff of interviewers at the beginning of the field period in February, 2008. Outside another major crash like we saw in 2008, your real estate investments will also not jump or plummet as quickly as stocks.

In an analysis published in 2009, Tom Therramus pointed out that Black Monday fell into a broader pattern in which nearly every stock market crash and recession of the preceding 50 years had occurred shortly after a large and abrupt change in the price of oil In the case of the 1987 Dow crash, it was foreshadowed by a tumble in oil price that ensued in the wake of disputes within OPEC , which had come to a head in the previous year.