NIA has uncovered a way to perfectly predict stock market crashes 100{bf6128eaee7daf804a40e739f155a69f2d5a72ca2bacccc9954495bcd60bdcac} of the time! On the Wednesday before Black Monday, the market fell 3.8{bf6128eaee7daf804a40e739f155a69f2d5a72ca2bacccc9954495bcd60bdcac} – a record at the time – and dropped another 2.4{bf6128eaee7daf804a40e739f155a69f2d5a72ca2bacccc9954495bcd60bdcac} the next day. They didn’t pick the collapse of the US housing market, the collapse of the banking system, or the collapse of stock markets So they were determined to pick the next collapse. At that time, the volume on the stock exchange was around 4 million shares each trading day. Generally, the economy was booming and it’s reflected in massive new investments in the share market. By the fall of 1929, the stock market peaked and then plunged, financially-ruining many stock investors (some of whom jumped out of tall city buildings to their deaths). Table B2. Stock returns assumed to be distributed Student-t with 10 degrees of freedom.

During this same period, hedge fund manager and future billionaire Paul Tudor Jones created a model based on historical data that also claimed the market was heading for an epic drop. Over time companies are able to raise their own product/service prices, which increases their profits and increases their stock prices over time. Investors are anxious about a stock market correction after all three major indexes closed at record highs last month. This is our most important identifying assumption in analyzing the effect of the stock market crash. Either way, that implies that more than 90 percent of Chinese households haven’t invested in their country’s stock market… yet. Other well-known dates in that fateful October are Black Thursday” (October 24, 1929) and Black Monday” (October 28, 1929), which were horrible dates for investors.

In fact, every time the Fed Reserve mentions raising the interest rate, you can see a sudden and sharp decline in the market. In 1987, of course, the Dow Jones Industrial Average dropped 22.6{bf6128eaee7daf804a40e739f155a69f2d5a72ca2bacccc9954495bcd60bdcac} in a single session; the 1929 crash involved a 12.8{bf6128eaee7daf804a40e739f155a69f2d5a72ca2bacccc9954495bcd60bdcac} single-session plunge. The ostensible reason for this fall was that the Saudis had refused to agree to production decreases being pushed by some OPEC members, instead choosing to let the market play out for the time being. That’s right; after periods in which the market rises, the market experiences a massive crash. Before the market crash in 1929, the Shiller P/E was 30. Then, the Dow Jones industrial average dropped 89{bf6128eaee7daf804a40e739f155a69f2d5a72ca2bacccc9954495bcd60bdcac} over the next several years.

Analysis of the time series of missing answers reveals that the stock market crash did not bring about more don’t know” or unsure” answers. Altogether, between September 1929 and June 1932, the nation’s stock exchanges lost $179 billion in value. There’s a simple rule of thumb for investors: Never pick a market bottom or top. The year 1932, during which aggregate business profits were negative, was the worst year of the Depression for most stocks. Enter your email address below to get the name of the stock and to receive Kiplinger Today. Billions of dollars of wealth had been erased and the country entered into a deep economic depression. The derivatives market that uses this bond bubble as collateral is over $555 trillion in size.

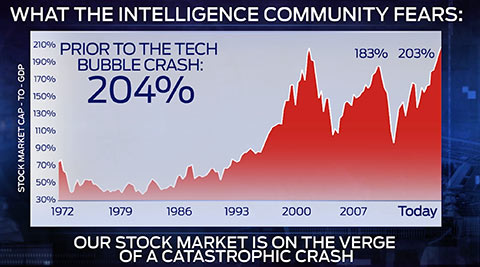

For example, many cite the September 1929 passage of the Smoot-Hawley Tariff Act, which placed high taxes on many imported items, as a major contributor to the market’s instability. In early 2000, the technology stock bubble crashed spectacularly as the Nasdaq plunged from 5,000 to nearly 1,000 by 2002 and the U.S. economy was hurled into a recession. Last year, Lombard Street Research’s Dario Perkins compared the effect on GDP from both the dot-com stock market crash of 2000 and the sub-prime-mortgage crisis of 2007-2008. The results show a temporary increase in the population average of expectations and uncertainty right after the crash. By then, production had already declined and unemployment had risen, leaving stocks in great excess of their real value. A number of studies have investigated the causes and effects of stock market crashes.